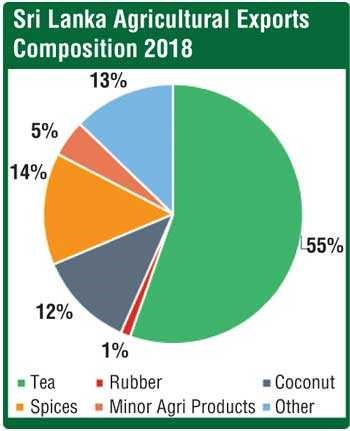

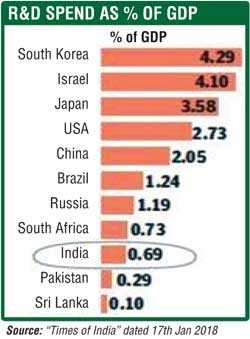

According MTI Consulting, Sri Lanka’s leading Strategy Consultancy (having worked on projects in over 40 countries), Sri Lanka needs immediate focus and investment in R&D, not branding campaigns. MTI also argues that to globally compete in branded retail products, requires very deep pockets as well as the ability to sustain such investments over decades. This is not possible for a country like Sri Lanka – for multiple reasons, as articulated below. Hence there is a need to convert the country’s agro-produce into functional food ingredients, that will generate a significant price premium. This is not possible without investment in R&D.

Sri Lanka is a relatively small nation in terms of land area, therefore cannot compete on mass-scale agricultural production within the likes of India, Pakistan and Bangladesh. Even in this small land area, Sri Lanka has a highly fragmented land ownership / agro-production structure – which means very low economies of scale and therefore lacks critical mass to invest in R&D. This is further compounded by the extremely low value-addition to the main crops.

If you have to, then invest in promoting Sri Lankan brands, not ‘Ceylon Tea’

If you are Sri Lanka Tourism, do promote the country – because the customer first decides on the country and then the hotel. But, not if you are ‘Ceylon Tea’, because the Customer first decides on the brand, in some cases the Retailer. The origin of the tea inside the pack of tea, if at all, only comes into the consumer’s consideration late in the decision making process.

By generic promotion of ‘Ceylon Tea’, you are essentially telling a Customer (be it in London, Moscow or Tehran) to walk into a Supermarket and insist on a brand that will have ‘Ceylon Tea Inside’ and then expect the supermarket to insist on their suppliers (who happen to be top global and regional brands) to shift to Pure Ceylon Tea. This is a tall order – especially with such meagre promotional budgets that Sri Lanka has at its disposal and that too spreading it across continents!

Instead, why not pick (through a transparent and objective process) one or two Sri Lankan brands with global growth potential and ‘invest’ these funds to further strengthen these brands globally?

Korea’s dominance in the global Techtronics domains was spearheaded by the likes of LG, Samsung and Kia and around these players the industry eco-system was built. Similarly, Sri Lanka’s apparel dominance in the global markets, was spearheaded by the likes of MAS, Brandix and Hirdaramani.

When it comes to Sri Lankan Tea, brands like Dilmah have contributed more to enhance the country reputation for tea (at consumer level) than generic ‘Ceylon Tea’ promotional campaigns.

A more ambitious approach would be to set-up a multi-billion dollar investment fund that will go out and acquire emerging global tea brands, including those in the fast growing Ready-to-Drink and Retailing segments, much like what Tata has done. Of course the unique challenge that Sri Lanka encounters, unlike in the case of a multi-national company, is that it must produce 330 million + kilos of tea – because the livelihood of over 1.5 million people depends on this. But, competing globally needs scale and the challenge for Sri Lanka is to be both small and big at the same time, much like what the New Zealand Dairy industry.

About MTI Consulting

MTI Consulting is an internationally-networked boutique management consultancy, offering advisory services range from strategic planning, corporate re-structuring, process re-engineering, performance management, international market entry, feasibility studies, due diligence, corporate finance, M&A, HR, executive search/head hunting, marketing strategy, branding to market research. Since its inception in 1997, MTI has worked on over 670 assignments in 43 countries, covering a diverse range of industries, clients and business challenges

MTI’s Thought Leadership Team comprising from left: Rajika Sangakkara (Sri Lanka), Hilmy Cader (CEO), Saima Mazhar (Bangladesh) and Darshan Singh (UK and Bahrain)